While the Christmas season is full of celebration, the markets are rather lulled during this time. That’s primarily because institutional traders, who contribute to the largest volume traded, are on vacation. But that doesn’t mean there is zero market activity – retail investors dominate the financial markets. And due to low liquidity, the markets are prone to high volatility. Let’s discuss which strategies can be used at Christmas time.

The Santa Claus rally

The Santa Claus rally is a persistent bullish trend in the financial markets during the week after Christmas – the last five trading days of the year and the first two days of the new year.

Yale Hirsch first documented this phenomenon in “Stock Trader’s Almanac” in 1972. Typically, the Santa Claus rally can also be used as an indicator for the new year. Yale Hirsch famously noted, “If Santa Claus should fail to call, bears may come …”.

Historically, the causes of the Santa Claus rally are ambiguous at best. Usually, the Christmas season marks the end of the tax-loss harvesting period, which begins during the fourth quarter and ends on December 31. Typically, investors timely sell off their loss-making securities to minimize capital gains. Psychologically, retail investors are also overly optimistic, which can lead to irrational exuberance. This may see them invest their end-year bonuses and reinvest the proceeds from tax-loss harvesting into the markets.

Now, remember that institutional traders and investors are on break, so liquidity is thin in the market. And that means increased buying activity from retail investors results in a significant bullish run.

But remember that while the Santa Claus rally can lead to a bull run during Christmas time, it may be outweighed by fundamentals. So, always do rigorous due diligence before investing in any security.

Volume trading

As we’ve mentioned, market liquidity is usually at its yearly lows during Christmas, owing to the low volume traded. Primarily, the majority of liquidity in the market comes from institutional traders and investors who are on holiday during the Christmas period. That leaves retail investors as the major players in the market.

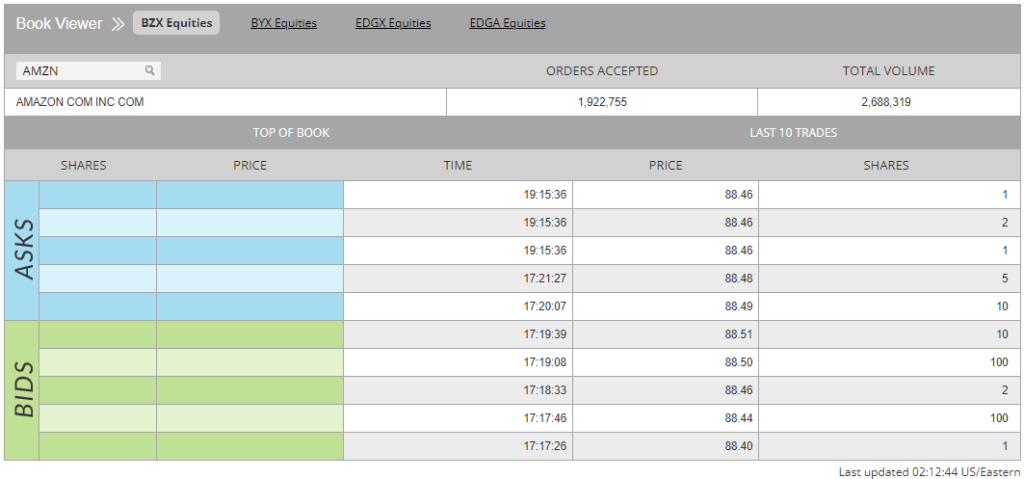

Historically, the price action around Christmas time tends to move sideways – in a consolidation phase. For the most part, your trading strategy should be based on the order flow. Every financial market, from Forex to the stocks market, openly displays its order books – showing all active bids and asking for buy and sell orders in terms of price and volume. It provides an accurate depiction of the depth of the market and the possibility of order execution, all signalling market sentiment.

Note that different exchanges and trading platforms may have different layouts for their order books. Here’s one from Cboe.

One of the greatest advantages of an order book is that it allows you to review the prices that buyers and sellers are willing to accept, along with the execution volume. And by analyzing them, you can determine the probability of future price action. Remember, the law of supply and demand rules markets. And given that there are fewer macro and micro market news, market volatility is almost entirely driven by volume traded.

But if you don’t have the technical know-how to analyse the order book, you can also use volume indicators. Most trading platforms offer several volume trading technical indicators. Ideally, increasing volume by buyers signals a potential bull run.

Picking retail and household-focused industries

Festivities and mass shopping go hand-in-hand – shoppers spend hundreds of billions during the Christmas holiday. And a huge chunk of this goes towards retailers, from online businesses to mall-based stores. In this regard, Black Friday sales may be a good indicator of overall Christmas sales. You may also focus on other economic indicators, such as the CPI and retail sales. These are good indicators of households’ purchasing power during the Christmas festivities – higher retail sales translate to a possible bull run.

Remember, this strategy specifically focuses on the short Christmas time. So best not to sit on the stocks for long – they only benefit from the excesses of the holiday season.

The Bottom Line

Many usually consider the holiday effect a financial market anomaly, but seasonal ups and downs are not uncommon. Christmas time is no exception. Since these seasonal fluctuations are predictable, you can position yourself to benefit from them. And we’ve discussed various strategies that can be used at Christmas time. Note that these strategies tend to be short-term since they are only seasonal.