The previous year was laden with unpleasant twists and slow economic growth cutting across several markets, sectors, and countries. As the year 2023 begins, predictions from financial experts worldwide are not looking very promising either. A slow global economic expansion is expected in 2023, and businesses must prepare for possible ways to protect their interests as the year progresses.

Here are some factors we expect to play out as the year advances.

1. General inflation

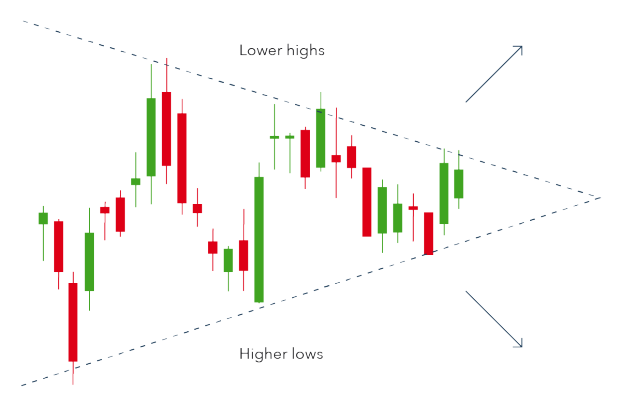

The battle against inflation rages on, and things still don’t look good. Interest rates stayed high through 2022 to discourage borrowing and help lower inflation. Businesses, however, suffered increased costs and fewer earnings. Experts predict that these increased rates will continue significantly affecting the stock market.

However, if the slow recovery from inflation continues, we might expect some relief and a better situation in the stock markets around the end of the year.

2. Population increase

One of the leading causes of economic instability remains migration. The resultant effect of this action directly impacts the population of the countries involved. When the country has a high population, more financial resources are required to keep up with the demand. Whatever the current population size of any leading nation is, this has the potential to affect future market supply and demand through prices and supply elasticity. Consumption and population changes are slow, which gives enough room to adjust distribution in a bid to achieve stability in the market supply.

3. Global food price

The effects of rising global food prices have plowed through the economy, from governing authorities, to impose trading restrictions and price control to consumers cutting back in different areas as they spend on groceries. In addition to partaking in the discretionary spending, the rising cost of global food prices have forced inflation to pose a serious threat to the recovery of the global economy. This is true, especially with regards to the emerging markets where food takes up a larger part. To bring a balance to this situation and secure a safe future, global food prices need to be controlled and set on a good course.

4. Cryptocurrency

The current surge of crypto prices has proven to be a significant point of concern about the growth of the global market. Following the rise of Bitcoin, other top gainers have attracted investors’ interest worldwide as the international market cap hits $1.1 trillion. Moreover, the development of utility tokens promises to lead the market in the right direction. For instance, Solana ($SOL) made a gain of over $5 in the last 14 days to contribute to the already-growing economy of digital assets.

5. Climate change

The effects of climate change have been a constant cause for concern. Several international organizations have continued to call the global community’s attention to the potential disruption of supply chains, labor challenges, rising insurance costs, and the impact of extreme weather events on businesses. Human activities like pollution, deforestation, burning fossil fuels, and so on continue to increase greenhouse gas emissions and accelerate the rate of global warming.

The impact is different for every country, and statistics show that many business owners around the globe worry about the impact on their businesses. Governments continue to intensify their efforts to reduce emissions. The new policies arising as a result of these strategies will have an effect on the stock market this year.

What next to investors: summary

In summary, it’s going to be a wild ride this year. As always, the global community must also expect surprises that could completely change the direction of things. While predictions may be correct, an unexpected turn of events can change the economic situation for better or worse.